BLOG

Are Tax Deferred Exchanges of Real Estate Approved by the IRS?

Internal Revenue Code Section 1031

The ability to do an exchange of like-kind property and to receive tax deferral on the gain has been provided for in Internal Revenue Code (IRC) Section 1031 since 1921. The primary reason behind Section 1031 is that if a taxpayer, who is known as an exchanger, is vested with a parcel of real estate and receives different real estate in a trade, and no cash, there is a continuity of the real estate holding. The gain on the sale of the first property, the “ Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The "Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property ” is deferred until the acquired property, the “Replacement Property” is sold without a further exchange. It was generally understood that the very definition of “exchange” meant that the transfer of the relinquished property and the acquisition of the replacement property had to take place simultaneously. Also, the taxpayer had to receive the replacement property from the same person to whom the taxpayer sold the relinquished property. As a result, exchanges were not often done.

The Starker Decision

This notion that an exchange had to be simultaneous was set aside in 1983 in a landmark legal decision, Starker vs. U.S. In that case the parties had agreed that the buyer would acquire Starker’s property up front but would allow Starker up to five years to find replacement property for the buyer to acquire and transfer back to Starker. The court held in favor of Starker and this began the era of doing exchanges on a delayed basis, often referred to as Starker exchanges or Starker trusts. In 1984, in response to the Starker decision, Congress added language to Section 1031 requiring that an exchange of relinquished property for replacement property had to be concluded within 180 days, allowing for these delayed exchanges.

1991 Treasury Department Regulations

During the course of several years after the Starker decision, due to a large amount of uncertainty about how to accomplish an exchange, the Treasury Department issued regulations in 1991 to address many of the unanswered questions (see Internal Revenue Service Regulations: IRC§1031). A portion of those regulations dealt with exchanges of real estate. Key provisions of the regulations provided a means for a taxpayer to sell relinquished property to a buyer of choice and to receive replacement property in exchange from a seller of choice, without requiring the taxpayer’s buyer to participate or cooperate in the exchange transaction. This was accomplished by the use of an “intermediary” to facilitate the exchange. The intermediary acquires the relinquished property from the taxpayer, transfers it to the buyer and within 180 days, acquires replacement property from the seller and transfers it to the taxpayer. The taxpayer is deemed to have completed an exchange with its intermediary. Under the regulations, certain persons or entities who are the agent of the taxpayer cannot act as A person acting to facilitate an exchange under section 1031 and the regulations. This person may not be the taxpayer or a disqualified person. Section 1.1031(k)-1(g)(4)(iii) requires that, for an intermediary to be a qualified intermediary, the intermediary must enter into a written "exchange" agreement with the taxpayer and, as required by the exchange agreement, acquire the relinquished property from the taxpayer, transfer the relinquished property, acquire the replacement property, and transfer the replacement property to the taxpayer. Intermediary , but all other persons or entities are “qualified” to act as A person acting to facilitate an exchange under section 1031 and the regulations. This person may not be the taxpayer or a disqualified person. Section 1.1031(k)-1(g)(4)(iii) requires that, for an intermediary to be a qualified intermediary, the intermediary must enter into a written "exchange" agreement with the taxpayer and, as required by the exchange agreement, acquire the relinquished property from the taxpayer, transfer the relinquished property, acquire the replacement property, and transfer the replacement property to the taxpayer. Intermediary and these persons are referred to as a "qualified intermediary", commonly referred to as a QI.

Retaining the Services of a Qualified Intermediary

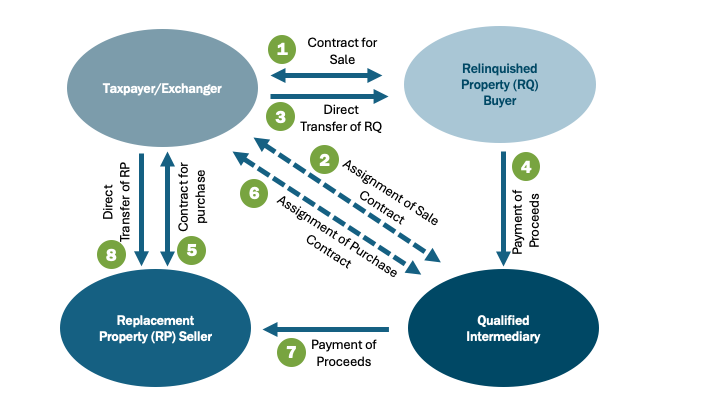

A QI is a necessity for delayed exchanges and the use of one allows the taxpayer to fall into a “safe harbor” as to the structure of the transaction. The regulations are purposely liberal on the mechanics of transferring the relinquished property to the QI and how to receive title to the replacement property back from the QI. One such permitted method, which is the industry standard, is to “assign rights” in the sale and purchase contracts to the QI. For tax purposes, the QI’s right to receive the property resulting from the assignment of rights is the same as if the QI took title from the taxpayer on the relinquished property and transferred title to the taxpayer on the replacement property. The taxpayer can still “direct deed” the property to the buyer and receive a deed from the seller. There are a few other requirements as well to meet this safe harbor.

A second problem was also addressed by the regulations. Prior to the regulations, to the extent that the taxpayer received and held the sale proceeds until being used for the purchase of the replacement property, the taxpayer was deemed to have a taxable sale, regardless if replacement property was bought within the 180 day time period. For a variety of reasons, the other option, like in the Starker case, allowing the buyer to hold those proceeds until the taxpayer needed to have them applied to the purchase of the replacement property was a risky proposition. So the regulations provided an additional “safe harbor” by allowing the QI to hold the funds or for the funds to be held in an escrow or trust account by a QI affiliate or by a third party. So a proper exchange then and now looks something like this:

Current Requirements of a 1031 Exchange

The 1991 regulations still cover how to complete an exchange to this day. Based upon the foregoing, documents such as the following are common to exchanges using a Qualified A person acting to facilitate an exchange under section 1031 and the regulations. This person may not be the taxpayer or a disqualified person. Section 1.1031(k)-1(g)(4)(iii) requires that, for an intermediary to be a qualified intermediary, the intermediary must enter into a written "exchange" agreement with the taxpayer and, as required by the exchange agreement, acquire the relinquished property from the taxpayer, transfer the relinquished property, acquire the replacement property, and transfer the replacement property to the taxpayer. Intermediary :

- Tax A 1031 exchange conducted under the safe harbor 1991 Treasury Regulations wherein the replacement property is received up to 180 days after the disposition of the relinquished property. Typically what people mean when referring to a 1031 exchange, Starker exchange, like-kind exchange, delayed exchange, etc. Deferred Exchange Agreement

- When a taxpayer is doing a delayed exchange, it has to link the sale and the later purchase together as an exchange of the one for the other. This is accomplished by transferring the relinquished property to the qualified intermediary and receiving back the replacement property from the qualified intermediary. In order to make this process as simple as possible, the IRS regulations state that by the taxpayer assigning the rights under the sale and purchase contracts to the qualified intermediary, for tax purpose that is sufficient to deem the properties to be exchanged between the taxpayer and the qualified intermediary. Assignment of Contract Rights to Sell Relinquished Property

- Section 1031(a)(3) and Section 1.1031(k)-1(c) provides that a written unambiguous description of the intended replacement property or properties, signed by the taxpayer must be sent to the qualified intermediary or other person who is a party to the exchange and who is not a disqualified person. Identification Notice from taxpayer to QI within 45 days of the sale of the Relinquished Property designating up to three properties the taxpayer may elect to acquire (additional designation rules may be applicable)

- When a taxpayer is doing a delayed exchange, it has to link the sale and the later purchase together as an exchange of the one for the other. This is accomplished by transferring the relinquished property to the qualified intermediary and receiving back the replacement property from the qualified intermediary. In order to make this process as simple as possible, the IRS regulations state that by the taxpayer assigning the rights under the sale and purchase contracts to the qualified intermediary, for tax purpose that is sufficient to deem the properties to be exchanged between the taxpayer and the qualified intermediary. Assignment of Contract Rights to Acquire the Replacement Property

Summary

Not only have tax deferred exchanges been permissible by the IRS since 1921, the ability to effectuate an exchange has been made much easier as a result of the decision in the Starker case and the regulations that followed. Those regulations, among other things, provide safe harbors for engaging the services of a QI with whom the taxpayer completes the exchange and for parties to hold the funds outside the control of the taxpayer. The 1031 exchange procedures are very form oriented and as long as the taxpayer, with the help of its QI, strictly follows the procedures, tax deferral upon the sale of real estate can be realized.