Operationalize 1031 Exchanges

Manage Tax and Distributions with a 1031 Exchange Program

BENEFITS

- Optimize portfolio by disposing of underperforming, low cost basis properties for more lucrative properties without tax implications

- Redeploy and leverage cashflow into more productive markets without a taxable event

- Rebalance portfolio markets per organizational guidelines

- Proactively manage distributions to REIT investors

CONSIDERATIONS

- Same taxpaying entity must dispose and acquire property for a valid Internal Revenue Code Section 1031 states that "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held for productive use in a trade or business or for investment." 1031 Exchange

- Recommended holding period for a Internal Revenue Code Section 1031 states that "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held for productive use in a trade or business or for investment." 1031 Exchange property is generally two years

- Generally, all real estate is like-kind to other real estate including raw land and improvements to new property

- Close of Relinquished and acquired properties can be simultaneous, or up to 180 days

Exchange Manager Pro℠

"Exchange Manager ProSM technology makes the 1031 transaction workflow very smooth and fast in tracking all the deadlines, documents and at the end of the transaction it produces a final report which help with filing the 8824 forms for the reporting the transaction to the IRS."

- Chief Accounting Officer, REIT

The Process

Exchange Manager Pro℠ automates the 1031 Exchange process through embedded controls. All documents, data, and timelines are tracked and visible in real-time. Each transaction is accessible by all parties 24/7.

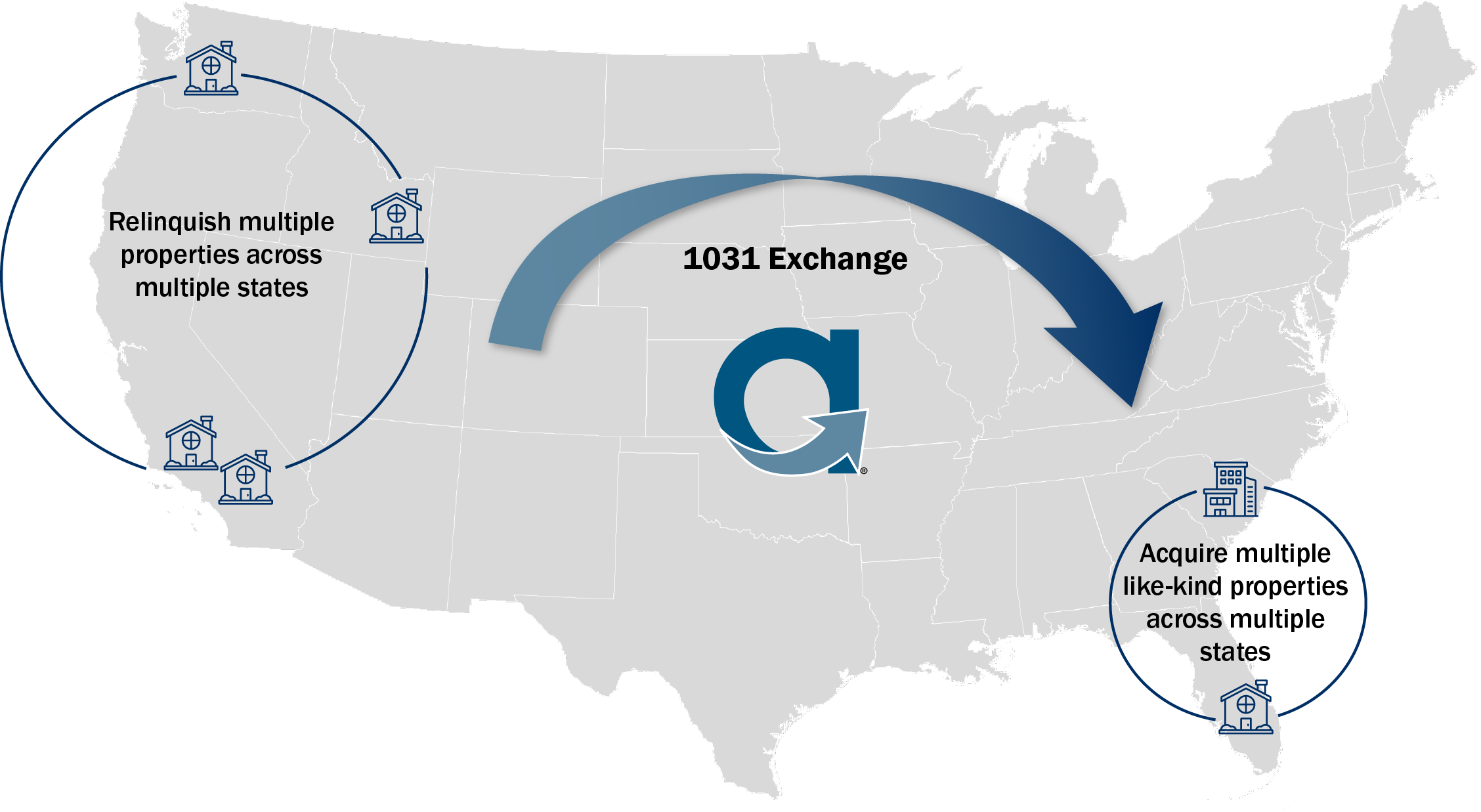

Property Disposition

Sell one, or several, properties across the US utilizing a 1031 exchange

Timeline

Completed sale starts 1031 exchange timeline. ID new property(ies) within 45 days, and acquire within 180 days

Electronic Processes

All exchange documents and communications are auto-generated with secure, digital document execution

Property Acquisition

Acquire one, or several, properties across multiple states to complete 1031 exchange

Reporting

Transparency & access to data and reports for Tax, Accounting, and Asset Management Departments through the system

Partner for Success

SOLUTION KNOWLEDGE

Successful implementation of 1031 programs for large scale clients.

Highly credentialed team of 1031 exchange experts including staff attorneys, CPAs, and Certified Exchange Specialists (CES®)

Facilitate all types of 1031 exchanges as both a Qualified Intermediary and Also referred to as an "EAT", is typically a special purpose, limited-liability company that is used to own the legal title to property that is being parked as part of a reverse exchange. An exchange accommodation titleholder may not be a disqualified person. Exchange Accommodation Titleholder

Patented 1031 exchange workflow technology, Exchange Manager ProSM, developed by Accruit Technologies

TRUSTED STEWARDS OF CAPITAL

Experience managing up to $9 billion annually in exchange transactions

Successful history of relationships with Fortune 500 companies

Industry leading safety and security of exchange funds:

$50 million Fidelity Bond

$25 million Errors & Omission

$15 million Cyber Liability

Subsidiary of Millennium Trust Company with over $70 billion in assets under custody

Service Offerings

TYPES OF 1031 EXCHANGES

Real estate transactions come in all shapes and sizes, 1031 exchanges are no different.

There are multiple types of 1031 exchanges that are suitable based on the specific circumstances of the real estate transactions, each type accomplishes tax deferral.

Forward

Exchange

Sell First, Buy Second

Considerations

Most common service offering, achievable in most stable markets.

Reverse

Exchange

Opposite of the Traditional

Buy First, Sell Second

Considerations

Useful in a Individual or entity that owns replacement property desired by the taxpayer. Seller 's Market when inventory is low and competition is high.

Build-to-Suit or

Improvement Exchange

Exchange funds are used to improve structures of build new on existing land

Considerations

Useful in high rate market, where the cost to build may be more economical than the cost to buy.

Specialty

Transactions

Reverse transactions that fall outside of the 180 day period, therefore deemed "Non- A safe harbor generally refers to a fact situation where under traditional tax or legal principles the proposed transaction, or part of a transaction, would be prohibited. If an otherwise prohibited transaction can be structured pursuant to an IRS promulgated safe harbor, the IRS agrees not to challenge the structure as to form. Safe Harbor "

Considerations

Varies by situation and requires extensive planning and consideration