BLOG

1031 Exchange & State Tax Withholding Requirements

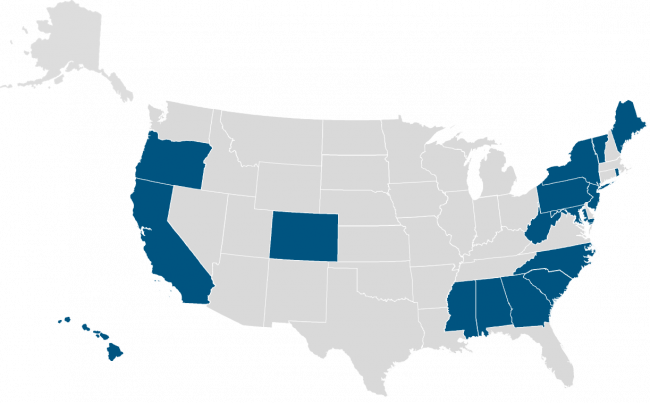

In certain states there is a mandatory tax withholding for nonresident individuals or businesses on the sale of real property. In performing a 1031 exchange you may be provided an exemption if executed properly. In the following section you will find a brief synopsis of the state withholding requirements. It is always important to consult your tax advisor before moving forward with a 1031 exchange. Failing to consult the correct professional advisors early could result in unnecessary taxes.

ALABAMA

- Withholding: 3% of the sales price for individuals; 4% of the sales price for business entities.

- Exemption: Submit form NR-AF3 (“ Individual or entity that owns replacement property desired by the taxpayer. Seller ’s Certificate of Exemption”)

- Further Information

CALIFORNIA

- Withholding: 3.33% of the sales price if the property is over $100,000.

- Exemption: Submit Form 593-C and certify as part of a 1031 exchange. Non-resident sellers seeking an exemption must submit Form 593-W to the California Franchise Tax Board.

- Further Information

COLORADO

- Withholding: 2% of the sales price if the property is over $100,000.

- Exemption: In a 1031 exchange, the non-Colorado resident may sign an “Affirmation of No Reasonably Estimated Tax to be Due” per Colorado Department of Revenue Form DR1083.

- Further Information

GEORGIA

- Withholding: 3% of the sales price if the property is over $20,000.

- Exemption: Individual or entity that owns replacement property desired by the taxpayer. Seller s performing a 1031 exchange and acquiring replacement property in Georgia are exempt and must submit Form IT-AFF3. Nonresident sellers purchasing replacement property out of Georgia are not exempt.

- Further Information

HAWAII

- Withholding: 5% of the sales price under the Hawaii The land, and everything that is permanently attached to the land, and all of the rights of ownership of that property. Real property is typically classified according to its general use as either residential, commercial, agricultural, industrial, or special purpose. Real Property Tax Act.

- Exemption: Completion of Form N-289 stating the seller is performing a 1031 exchange.

- Further Information

MAINE

- Withholding: 2.5% of the sales price if the property sold is over $50,000.

- Exemption: Submitting Form REW-5 at least two weeks prior to closing.

- Further Information

MARYLAND

- Withholding: 7.5% by nonresident individual and 8.25% by nonresident entity.

- Exemption: Submit Form MW506AE at least 21 days prior to closing to the Maryland Comptroller’s Office if there is no boot. The state of Maryland also requires a letter from the qualified intermediary stating the amount of boot.

- Further Information

MISSISSIPPI

- Withholding: 5% of the sales price if the property sold is over $100,000.

- Exemption: If the seller is performing an exchange, they may provide the buyer with an affidavit stating no gain is to be recognized on the sale because they are performing an exchange and purchasing replacement property in Mississippi.

- Further Information

NEW JERSEY

- Withholding: The buyer must file Form C-9000 with the Division of Taxation at least 10 days before closing. Within 10 days, the Division will forward a notice of the amount to be held in escrow at the closing including existing tax debts, delinquencies, assessments and tax on gain from the sale of property.

- Exemption: The seller may file an Asset Transfer Tax Declaration form to assist the Division in calculating the estimated tax on the gain. The Division has the discretion to adjust the escrow amount held. Payment of the taxes is made from the escrow account.

- Further Information

NEW YORK

- Withholding: 7.7% of the capital gain.

- Exemption: Submit Form IT-2663 and providing a brief summary of the exchange before closing with the New York State Department of Taxation and Revenue.

- Further Information

NORTH CAROLINA

- Withholding: 4% of the sales price. The buyer must file a return with the Secretary of the State of North Carolina within 15 days of the sale closing.

- Further Information: NC Tax Code, Section 105-163

OREGON

- Withholding: The lesser of 4% of the consideration or 8% of the gain or proceeds for individuals and C Corporations.

- Exemption: Submit Form WC exemption form.

- Further Information

PENNSYLVANIA

- Historically: Pennsylvania did not recognize the Federal 1031 exchange gain deferral rules and state income taxes must be paid when there is gain on the sale of Pennsylvania property, or for Pennsylvania taxpayer selling out of state property.

- Update: On July 8th, 2022, House Bill 1342 was signed into law stating, effective with the 2023 tax year, Pennsylvania will join the rest of the states in recognizing Section 1031 exchange deferrals for state tax purposes. There is no withholding.

RHODE ISLAND

- Withholding: 6% of the sales price for nonresident individuals and 9% for nonresident corporations.

- Exemption: Submit RI Form 71.3 stating the sale is exempt due to 1031 exchange.

- Further Information

SOUTH CAROLINA

- Withholding: 7% for individuals and 5% for corporations.

- Exemption: Completion of Form I-295.

- Further Information

VERMONT

- Withholding: 2.5% of the sales price.

- Exemption: A nonresident seller can request an exemption for performing a 1031 exchange by filing a request for Withholding Certificate and presenting this Certificate to the buyer prior to closing. A separate tax, the Vermont Land The amount received for a property, minus the property’s adjusted basis and transaction costs. Regardless of the adjusted basis of a property, there is no gain until the property is transferred. There are two types of gain: “realized gain” and “recognized gain.” Realized gain is the difference between the total consideration (cash and anything else of value) received for a piece of property and the adjusted basis. Realized gain is not taxable until it is recognized. Gain is usually, but not always, recognized in the year in which it is realized. If gain is not recognized in the year it is realized, it is said to be deferred. In an exchange under Section 1031, realized gain is recognized in part or in full to the extent that boot is received. See Boot. Where only like kind property is received, no gain is recognized at the time of the exchange. Gain s tax, exempts only exchanges of Vermont land for Vermont land.

- Further Information

WEST VIRGINIA

- Withholding: 2.5% of the sale proceeds or estimated capital gain.

- Exemption: File Form WV.NRAE with the State Tax Department no later than 21 days before closing.

- Further Information: West Virginia Code 11-21-71b

Information presented in this article should not be perceived as tax or legal advice. Please consult your attorney and tax advisor before proceeding with a 1031 exchange.

Updated 7/15/2022