BLOG

1031 Exchange Timeline FAQs

What is the 1031 Exchange timeline?

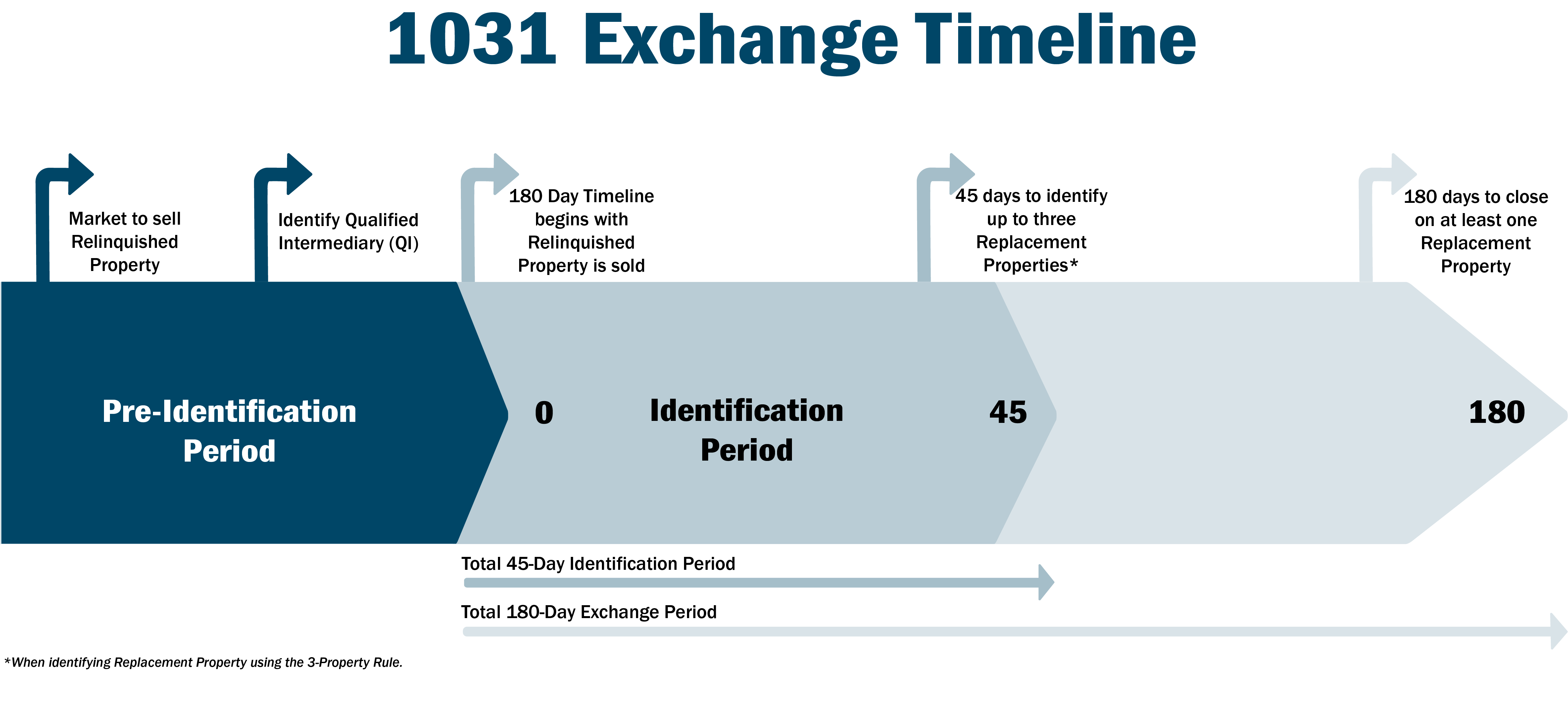

The 1031 exchange timeline is just that, the timeline in which a valid 1031 exchange must adhere to. From the closing date of the sale of the Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The "Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property , the clock starts. The 1031 exchange time frame goes by calendar days, not business days and it does not recognize holidays.

Breakdown of 1031 Timeline

45-Day Identification Period

From the closing date of the sale, the (“Exchangor” or “Taxpayer”) Person intending to conduct a 1031 tax deferred exchange, who transfers a relinquished property and thereafter receives a replacement property. Exchanger has 45-days to identify potential Replacement Property. Before day 46 the potential Replacement Property must be identified meeting the following identification requirements:

Signed and in writing

Delivered to the QI, Individual or entity that owns replacement property desired by the taxpayer. Seller , or other party involved in the exchange such as an escrow agent or title company

Must be unambiguously described using either the street address, a legal description, or distinguishable name such as Denver Coliseum

The identification of Those certain items of real and/or personal property qualifying as “replacement property” within the meaning of Treasury Regulations Section 1.1031(k)‑1(a) and either: (a) received by the taxpayer within the designation period in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(1) or (b) identified in a written designation notice signed by the taxpayer and hand delivered, mailed, telecopied or otherwise sent to the qualified intermediary before the end of the designation period in accordance with Treasury Regulations Sections 1.1031(k)‑1(b) and (c). The definition of “replacement property” shall not include property the identification of which has been revoked by the taxpayer in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(6); (“New Asset”) Property or properties properly received by a taxpayer as part of a 1031 exchange. Replacement Property must also follow one of three rules:

3-Property Rule

As a practical matter, the vast majority of most people utilize the 3-property rule which does not require any special considerations. But once, an exchanger exceeds three properties, he needs to acquire all of them unless the value of all of them is not more than twice the value of the one sold. Technically not “all” need to be acquired, but the rules refer to at least 95% in value has to be acquired. Since 95% is basically equivalent to 100%, this rule can seldom be relied upon.

180-Day Exchange Period

From the closing date of the sale, the (“Exchangor” or “Taxpayer”) Person intending to conduct a 1031 tax deferred exchange, who transfers a relinquished property and thereafter receives a replacement property. Exchanger has a full 180-day time frame to acquire their identified Replacement Property, but subject to the the (“Exchangor” or “Taxpayer”) Person intending to conduct a 1031 tax deferred exchange, who transfers a relinquished property and thereafter receives a replacement property. Exchanger ’s tax return filing due date for the year in which the sale took place. Therefore, in order for an (“Exchangor” or “Taxpayer”) Person intending to conduct a 1031 tax deferred exchange, who transfers a relinquished property and thereafter receives a replacement property. Exchanger to receive their full 180-day exchange period for a 1031 exchange started in the fourth quarter of the year, they would need to file for an extension on their tax return, otherwise their exchange must be completed by their tax return due date, approximately April 15th for individuals.

Extensions to 1031 Exchange Time Limits

The only way in which an extension is granted for either the 45-Day or 180-day periods would be one of the following:

Federally declared disaster: If the (“Exchangor” or “Taxpayer”) Person intending to conduct a 1031 tax deferred exchange, who transfers a relinquished property and thereafter receives a replacement property. Exchanger lives within an area of a federally declare national disaster. Tax relief of these kinds of issued by the IRS and can be found online.

Acts of Terrorism: Similar to the above, if the (“Exchangor” or “Taxpayer”) Person intending to conduct a 1031 tax deferred exchange, who transfers a relinquished property and thereafter receives a replacement property. Exchanger resides in an area affected by acts of terrorism, the IRS could declare an extension.

Military Action: For (“Exchangor” or “Taxpayer”) Person intending to conduct a 1031 tax deferred exchange, who transfers a relinquished property and thereafter receives a replacement property. Exchanger s serving in combat zones, they can qualify for tax extensions including 1301 exchange related time limits.

Frequently Asked Questions on 1031 Exchange Timeline

Below are some frequently asked questions involving the 1031 exchange timeline, the specific time limits for a 1031 exchange, and the rules of the timeline.

Do I still have to identify Replacement Property if I purchase it before Day 45?

If you purchase your Those certain items of real and/or personal property qualifying as “replacement property” within the meaning of Treasury Regulations Section 1.1031(k)‑1(a) and either: (a) received by the taxpayer within the designation period in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(1) or (b) identified in a written designation notice signed by the taxpayer and hand delivered, mailed, telecopied or otherwise sent to the qualified intermediary before the end of the designation period in accordance with Treasury Regulations Sections 1.1031(k)‑1(b) and (c). The definition of “replacement property” shall not include property the identification of which has been revoked by the taxpayer in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(6); (“New Asset”) Property or properties properly received by a taxpayer as part of a 1031 exchange. Replacement Property before Day 45, you do not have to officially identify it, the purchase counts toward the identification requirements. The purchase however will count toward the 3-property, 200% or 95% rules. If you have left over exchange proceeds you will need to identify additional Those certain items of real and/or personal property qualifying as “replacement property” within the meaning of Treasury Regulations Section 1.1031(k)‑1(a) and either: (a) received by the taxpayer within the designation period in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(1) or (b) identified in a written designation notice signed by the taxpayer and hand delivered, mailed, telecopied or otherwise sent to the qualified intermediary before the end of the designation period in accordance with Treasury Regulations Sections 1.1031(k)‑1(b) and (c). The definition of “replacement property” shall not include property the identification of which has been revoked by the taxpayer in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(6); (“New Asset”) Property or properties properly received by a taxpayer as part of a 1031 exchange. Replacement Property before Day 46 to avoid a taxable event.

Is there any way to get an extension on my 45-Day Identification Period?

No, there is no way to get an extension for either the 45-Day Identification period or the 180-Day Exchange period, except for a federally declared disaster, acts of terrorism declared by IRS, or (“Exchangor” or “Taxpayer”) Person intending to conduct a 1031 tax deferred exchange, who transfers a relinquished property and thereafter receives a replacement property. Exchanger carrying out military duty in a combat zone.

What happens if I am unable to identify Replacement Property within 45 days?

If you are unable to identify Those certain items of real and/or personal property qualifying as “replacement property” within the meaning of Treasury Regulations Section 1.1031(k)‑1(a) and either: (a) received by the taxpayer within the designation period in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(1) or (b) identified in a written designation notice signed by the taxpayer and hand delivered, mailed, telecopied or otherwise sent to the qualified intermediary before the end of the designation period in accordance with Treasury Regulations Sections 1.1031(k)‑1(b) and (c). The definition of “replacement property” shall not include property the identification of which has been revoked by the taxpayer in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(6); (“New Asset”) Property or properties properly received by a taxpayer as part of a 1031 exchange. Replacement Property within 45 days, your 1031 exchange will be voided, and you will receive your exchange funds back on day 46 which will be subject to payment of applicable taxes.

I am planning on purchasing two Replacement Properties, how many properties can I identify?

The number of properties you can identify depends on which of the three available identification rules you want to follow. If you use the 3-property rule, you can identify a total of three properties, regardless of value. If you use the 200% rule you can identify an infinite number of properties so long as the fair market value total of all properties does not exceed 200% of the relinquished property value. If you exceed the 200% rule, you can use the 95% rule and identify an indefinite number of properties, but you must acquire 95% of the value you have identified which can be very difficult. It is important to note that if you intend on acquiring more than one Those certain items of real and/or personal property qualifying as “replacement property” within the meaning of Treasury Regulations Section 1.1031(k)‑1(a) and either: (a) received by the taxpayer within the designation period in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(1) or (b) identified in a written designation notice signed by the taxpayer and hand delivered, mailed, telecopied or otherwise sent to the qualified intermediary before the end of the designation period in accordance with Treasury Regulations Sections 1.1031(k)‑1(b) and (c). The definition of “replacement property” shall not include property the identification of which has been revoked by the taxpayer in accordance with Treasury Regulations Section 1.1031(k)‑1(c)(6); (“New Asset”) Property or properties properly received by a taxpayer as part of a 1031 exchange. Replacement Property that you note on your identification the number of properties you intend to acquire to avoid having additional property available and funds in the account when it was never intended to buy that many properties.

What if I identify property within the 45-day window but choose not to proceed with the exchange and just pay the tax?

Due to a somewhat harsh Private Letter Ruling, it is very difficult to receive and early return on the funds. In most cases the exchanger has to wait until the exchange period expires. Once exception is if the choice not to proceed pertains to a written contingency that could not be met and that is beyond the control of the exchanger. An example would be that a purchase offer was contingent on a zoning variance which the municipality would not grant.

If I identify in a specific tax year and am not able to receive a return on the funds until the next tax year, what are my reporting obligations?

For a 1031 exchange spanning two tax years, the default position is that the capital gain portion of your taxes do not have to be paid until you file the return for the year in which you received the funds, as opposed to the year of the sale. If a person has losses that they incurred in the year of the sale and wish to offset those, they can make an election to report those in the year of the sale.

Is there a specific form to complete to identify Replacement Property?

There is not a specific required document that you must complete, however you must adhere to the identification rules outlined above in order for the identification to be valid. As a convenience, Accruit does provide (“Exchangor” or “Taxpayer”) Person intending to conduct a 1031 tax deferred exchange, who transfers a relinquished property and thereafter receives a replacement property. Exchanger s with a Designate Notice for identifying their Replacement Properties.

What qualifies as the closing or transfer date of the Replacement Property in a 1031 exchange?

The specific criteria that must be met to complete a 1031 exchange within the 180-day exchange period, is the “benefits and burdens” of ownership is transferred.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified A person acting to facilitate an exchange under section 1031 and the regulations. This person may not be the taxpayer or a disqualified person. Section 1.1031(k)-1(g)(4)(iii) requires that, for an intermediary to be a qualified intermediary, the intermediary must enter into a written "exchange" agreement with the taxpayer and, as required by the exchange agreement, acquire the relinquished property from the taxpayer, transfer the relinquished property, acquire the replacement property, and transfer the replacement property to the taxpayer. Intermediary , and as such does not offer or sell investments or provide investment, legal, or tax advice.