BLOG

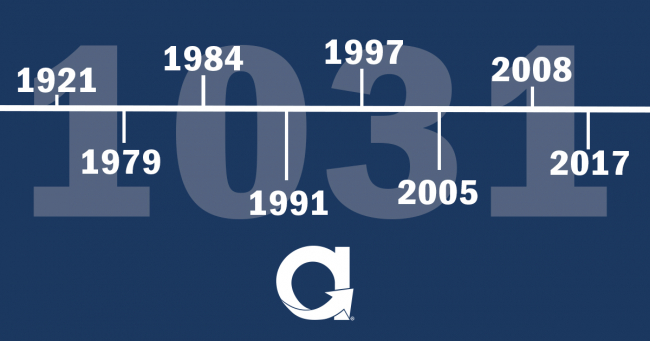

How the 1031 Exchange Process has Evolved Over Time

The 1031 Exchange has been a popular tax strategy for real estate investors for over a century, but its history and evolution are often overlooked. By understanding how this tax strategy has developed and changed over time, investors can make more informed decisions about their investments and take advantage of the benefits associated with a 1031 Exchange.

Originally established as part of the Revenue Act of 1921, 1031 Exchanges were designed to encourage investment and growth in the real estate market. The basic idea behind the exchanges was simple; by allowing investors to exchange one property for another without incurring capital gains, or other related taxes, the government could incentivize investors to keep their money in real estate and continue investing in new properties.

Over the years, the rules and regulations governing 1031 Exchanges have changed in response to new economic and political realities. For example, in 1979, the 9th US Circuit Court of Appeals approved “delayed exchanges” in the Starker case, which allowed investors to sell their property before acquiring a replacement property, therefore eliminated the requirement for a simultaneous exchange. The case involved not only the first non-simultaneously structured exchange but provided for a five-year time frame for Starker to receive his replacement property. In direct response to the open-ended period, in 1984, Congress codified the 45 and 180-day restrictions presented in Starker {Sec. 1031(a)(3)}, and prohibited exchanges of partnership interests {Sec. 1031(a)(2)(D)}. These narrower time frames provided a nexus between the sale and purchase.

In 1991, Section 1031 Regulations were issued, outlining four “Safe Harbors” including: how the exchange funds could be held so that the Taxpayer was not in constructive receipt; allowing funds to be put into a Trust or Escrow; the use of a Qualified Intermediary which took the place of the buyer in connection with the Taxpayers intent to exchange and; allowing the Taxpayer to earn interest on their funds, which previously was not allowed because that would be considered in “constructive receipt” of the funds.

In 1997, the Taxpayer Relief Act introduced a provision stating that domestic property and foreign property are not considered like-kind. This means that real estate investors could no longer exchange their domestic properties for foreign ones or vice versa using a 1031 exchange. However, the act did not change the rules around like-kind exchanges for properties within the United States. This clarification helped to ensure that investors could continue to use 1031 exchanges as a powerful tax strategy for domestic real estate investments. It also remained possible to exchange one foreign property for another foreign property.

In 2005, the IRS issued Revenue Procedure 2005-14, which provided guidance for combining Section 121 and Section 1031, which has implications for (a) rental property converted to primary residence, and (b) primary residence converted to rental property.

In 2008, the IRS issued Revenue Procedure 2008-16 which provided addition guidance and restrictions on vacation/second homes. The restrictions included the requirement that the Relinquished Property be held for investment for at least 24 months immediately preceding the exchange, and within each of the 12-months the property must have been rented out at fair market value for at least 14 days, and the owners personal use could not exceed 14 days or 10% of the total time the property was rented out. The same restrictions were put place for the Replacement Property.

More recently, the Tax Cuts and Jobs Act of 2017 made significant changes to the 1031 Exchange process, eliminating the ability to use 1031 Exchanges for personal property and limiting its use to real estate investments. The act also introduced new restrictions on the types of properties that could be exchanged, including stricter requirements for vacation homes and other non-primary residences.

Despite these changes, the core idea behind the 1031 exchange process remains the same, to incentivize real estate investment and promote growth in the real estate market. Whether you're a seasoned investor or just getting started in the world of real estate, understanding the history and evolution of 1031 Exchanges is essential to making informed decisions about your investments and maximizing the benefits of this powerful tax strategy.