BLOG

The IRS Announces Tax Relief for California Taxpayers Impacted by Wildfires

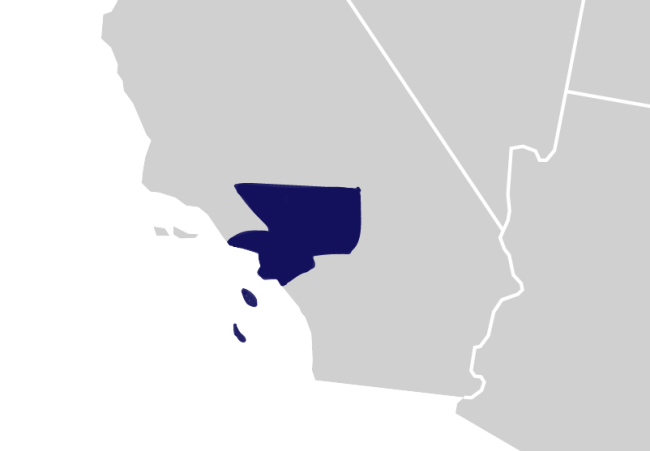

Due to California wildfires, the IRS has issued Tax Relief for Los Angeles County.

Affected (“Exchangor" or "Exchanger") Individual or entity desiring an exchange. Taxpayer s have until October 15, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Los Angeles County qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

Who is an "Affected (“Exchangor" or "Exchanger") Individual or entity desiring an exchange. Taxpayer "?

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The "Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property or Replacement Property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Relief Specific to Internal Revenue Code Section 1031 states that "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held for productive use in a trade or business or for investment." 1031 Exchange s for Affected Taxpayers

General Postponement under Section 6 of Rev. Proc. 2018-58 under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The "Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Relief for (“Exchangor" or "Exchanger") Individual or entity desiring an exchange. Taxpayer s with Related Difficulties

Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The "Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The "Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

Visit for full details on the tax relief for Los Angeles wildfires.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified A person acting to facilitate an exchange under section 1031 and the regulations. This person may not be the taxpayer or a disqualified person. Section 1.1031(k)-1(g)(4)(iii) requires that, for an intermediary to be a qualified intermediary, the intermediary must enter into a written "exchange" agreement with the taxpayer and, as required by the exchange agreement, acquire the relinquished property from the taxpayer, transfer the relinquished property, acquire the replacement property, and transfer the replacement property to the taxpayer. Intermediary , and as such does not offer or sell investments or provide investment, legal, or tax advice.