BLOG

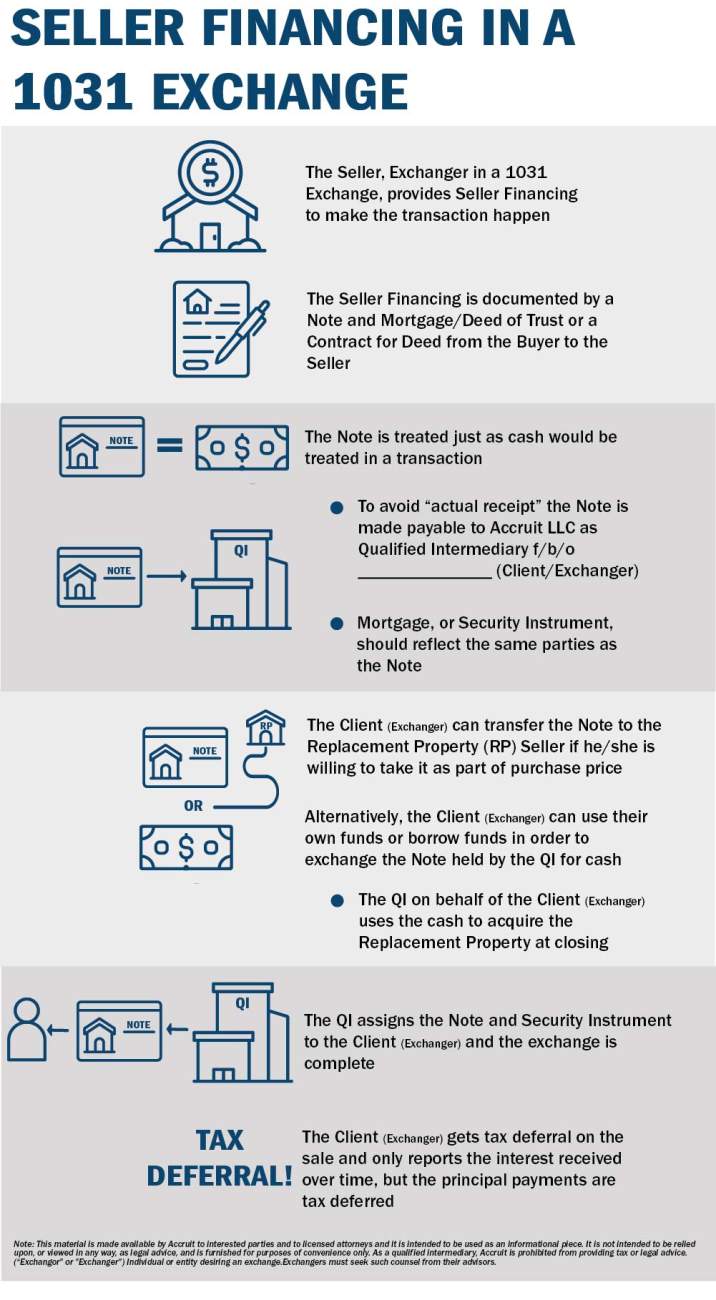

Seller Financing in a 1031 Exchange Infographic

How to do Seller Financing in a 1031 Exchange?

Our infographic below covers the process of Seller Financing in a Internal Revenue Code Section 1031 states that "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held for productive use in a trade or business or for investment." 1031 Exchange at high level.

For more information on Seller Financing in relation to a Internal Revenue Code Section 1031 states that "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held for productive use in a trade or business or for investment." 1031 Exchange , reach out to our team of experts!