BLOG

A Year In Review: 2023

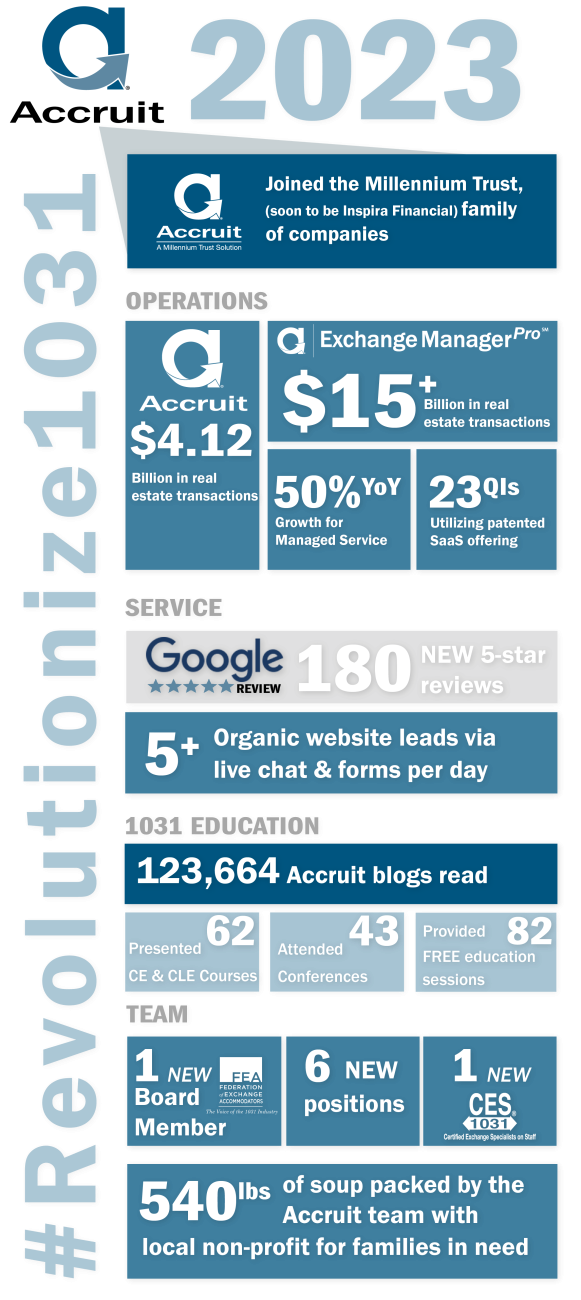

2023 was a year of unknowns for much of the real estate industry and adjacent industries like Internal Revenue Code Section 1031 states that "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held for productive use in a trade or business or for investment." 1031 Exchange Qualified Intermediaries. With interest rates reaching a 20 year high, recession, inflation, all while real estate prices held steady and high - it was a challenging market for many.

Accruit's team didn't let these factors impact their goals for growth and innovation. It was a great 2023 and Accruit's team couldn't be more proud of the results.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified A person acting to facilitate an exchange under section 1031 and the regulations. This person may not be the taxpayer or a disqualified person. Section 1.1031(k)-1(g)(4)(iii) requires that, for an intermediary to be a qualified intermediary, the intermediary must enter into a written "exchange" agreement with the taxpayer and, as required by the exchange agreement, acquire the relinquished property from the taxpayer, transfer the relinquished property, acquire the replacement property, and transfer the replacement property to the taxpayer. Intermediary , and as such does not offer or sell investments or provide investment, legal, or tax advice.