September

13

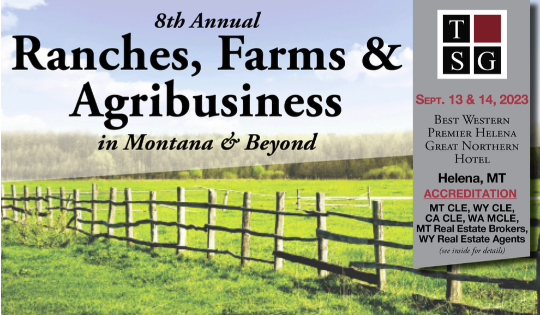

8th Annual Ranches, Farms and Agribusiness in Montana & Beyond

Accruit's Max Hansen and Jonathan Barge will be presenting Changing Landscape in Internal Revenue Code Section 1031 states that "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held for productive use in a trade or business or for investment." 1031 Exchange , an interesting segment on Internal Revenue Code Section 1031 states that "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held for productive use in a trade or business or for investment." 1031 Exchange s including topics such as: What is real property?, Recent Regulations Impact, Recurring Issues and Specialty Reverse Exchange Transactions. In addition to their segment, they will be co-moderating with attorney Gage Zobel a host of other equally insightful presentations outlined in the Seminar Overview below. This program is a must for any professionals engaged in real estate transactions anywhere in the West!

Seminar Overview

Owning a piece of “Montana heaven” is becoming increasingly popular, but unique issues arise when purchasing agricultural assets in Montana. Understanding these unique issues can help buyers, sellers, lenders, attorneys, and consultants to troubleshoot purchases of agricultural assets.